Volume Analysis | Flash Update – 3.24.25

The markets may have broken their down streak last week, but the victory was far from decisive. The elite forces of the market, represented by the SPDR S&P 500 ETF (SPY), lagged behind their comrades, finishing up a modest 0.21%. Meanwhile, the generals, embodied by the Invesco QQQ Trust (QQQ), marched ahead with a gain of 0.25%. The supporting ranks showed stronger performance, with the equal-weight brass commander unit, Invesco S&P 500 Equal Weight ETF (RSP), leading the charge with a 0.68% increase, followed closely by the dividend commander unit, Schwab US Dividend Equity ETF (SCHD), at 0.43%, and the troops, iShares Russell 2000 ETF (IWM), advancing by 0.44%.

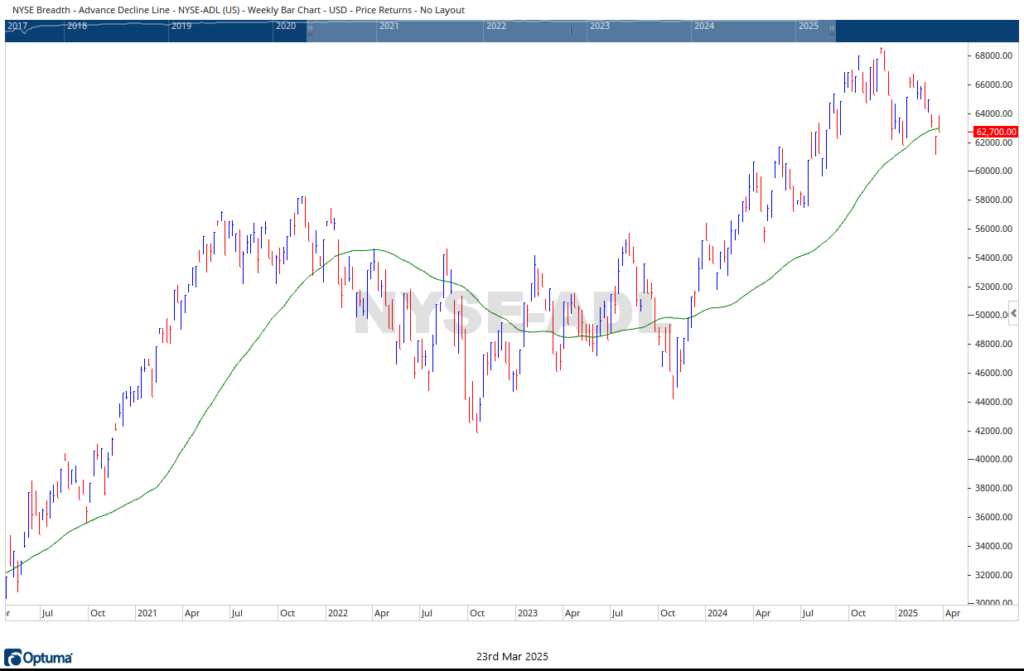

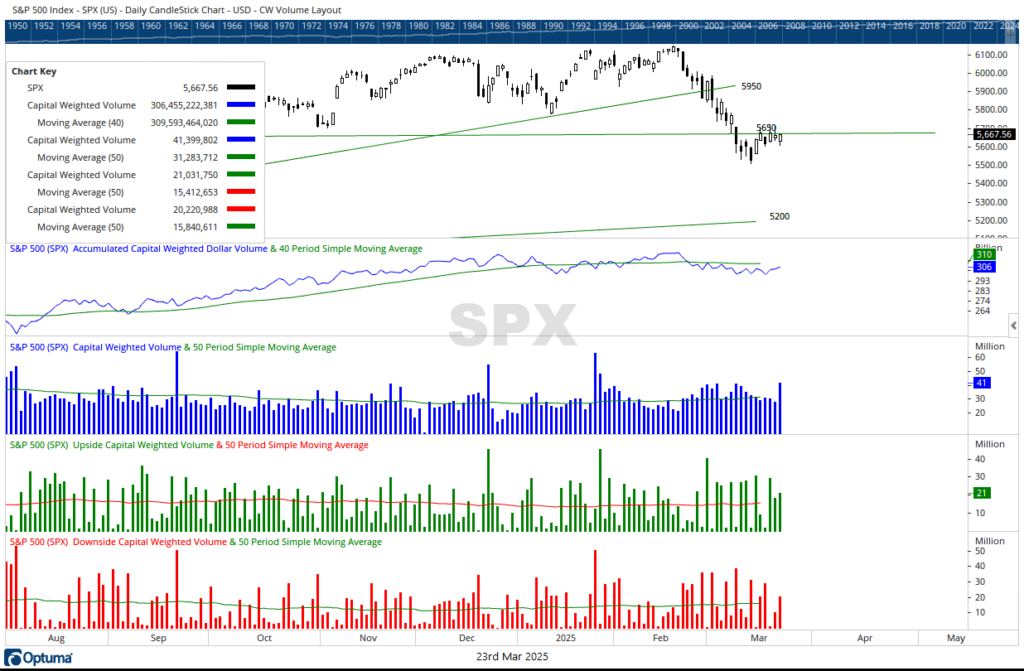

The week commenced with the S&P 500 rising on Monday, the 17th. However, Capital Weighed Downside Volume actually led the charge, with a staggering 16 billion in volume compared to just 6 billion in upside volume. Tuesday saw the downside volume continue its onslaught, with 29 billion in downside volume overshadowing a mere 2 billion in upside volume. A complete reversal occurred on Wednesday, where upside volume surged to 29 billion against just 1.9 billion in downside volume. Despite the market finishing higher for the week, downside volume slightly edged out upside volume. Market breadth remained positive, with the advance-decline line advancing further above trend.

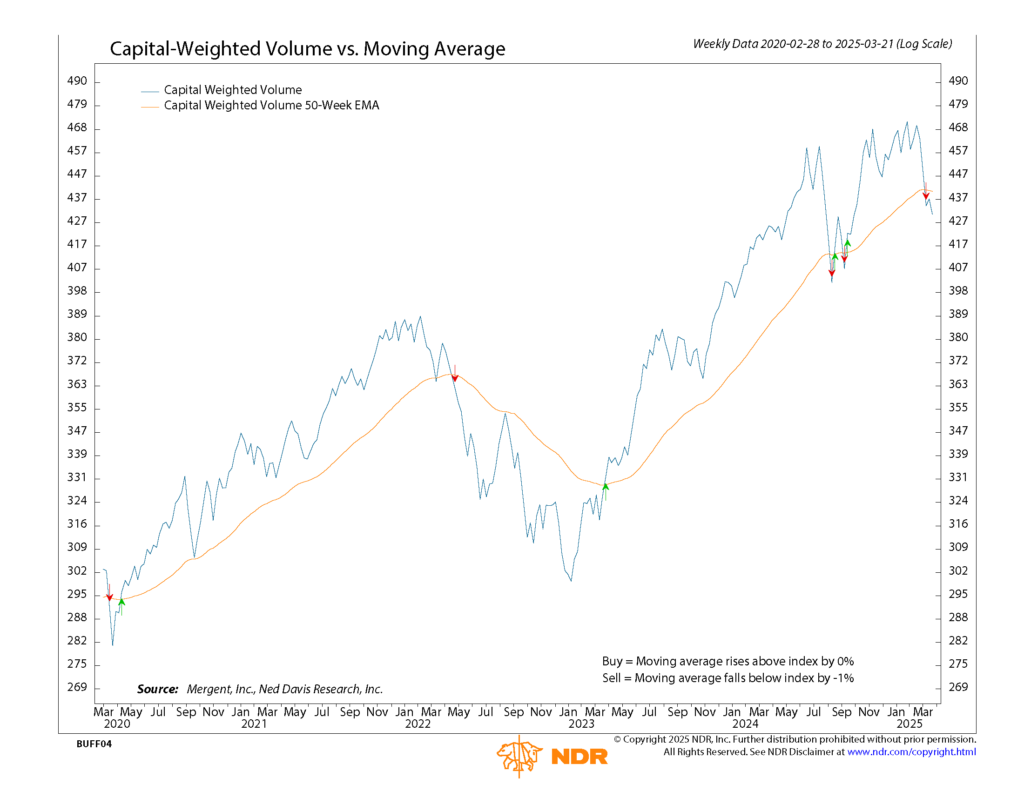

Although the S&P 500 closed the week higher, there remains a troubling trend in Capital Weighted Dollar Volume, which continued its descent. The key takeaway from the week is that Capital Weighted Dollar Volume closed beneath trend. Meanwhile, its sibling Capital Weighted Volume, has been under trend for three consecutive weeks. With both Capital Weighted Volume and Dollar Volume now below trend, we find ourselves officially in a Volume Analysis Bear Market. The caveat to this market state is the presence of last week’s VPCI V bottom oversold conditions, creating a precarious position for investors.

In conclusion, while the markets may have shown some signs of life, the underlying volume dynamics suggest a cautious approach. The recent gains, though welcome, have yet to exhibit the robust support needed for a sustained rally. Investors should remain vigilant, as the current bear market conditions, coupled with oversold signals, present both risks and opportunities. As the battle for dominance continues, strategic positioning will be essential in navigating the uncertain terrain ahead.

Grace and peace my friends,

BUFF DORMEIER, CMT

Updated: 3/24/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.