Volume Analysis | Flash Update – 3.17.25

Transitioning from Defense Back to Offense

Last week, we assessed the market’s setup for potential capitulation, though our volume indicators had yet to trigger. However, the battlefield shifted this past Thursday (3/13) when the generals (QQQ) and Friday (3/14) when our elite forces (SPY) both registered VPCI V-bottoms—marking a possibly significant turning point in volume sentiment.

VPCI V-Bottom: Tactical Reentry Strategy

The VPCI V-bottom represents a deeply oversold condition where the SPY’s Volume Price Confirmation Indicator (VPCI) plunges below -4 and its lower Bollinger Band. This setup indicates extreme selling pressure and investor capitulation. Our reentry signal fires once these conditions are met and the VPCI crosses back above its lower Bollinger Band, signaling that weak hands may have fully surrendered, clearing the way for a potential strategic counterattack.

In warfare, victory often belongs not to the strongest, but to the force that capitalizes on the enemy’s weakness. When investors panic and abandon their positions en masse, the battlefield may be ripe for a tactical resurgence. This is why we monitor volume sentiment for rare instances of extreme fear—contrary to intuition, these may be the best moments to charge back in.

Volume Sentiment and Market Extremes

The VPCI calculates the asymmetry between price trends and corresponding volume, helping to pinpoint market extremes. Think of it this way: Do you know anyone who is always right? Unlikely. But you probably know investors who consistently react at the worst possible moments—buying into hype (greed) and selling in panic (fear). There’s a ticker symbol that may track these emotional retail investors behavior: SPY.

SPY, the SPDR S&P 500 ETF, may serve as a proxy for market sentiment. In bear market bottoms, SPY’s volume often tends to surge as panic selling intensifies. We look for this volume-price relationship to drive our VPCI two standard deviations below its lower Bollinger Band, marking a potential washout bottom. Over the past few weeks, SPY’s daily volume nearly doubled, setting the stage for this very event. Our trigger? VPCI rising back above its lower Bollinger Band—a sign that the last weak hands have surrendered and that a potential reversal is in play. This capitulation trigger was pulled last week in both the QQQ’s and the SPY.

Battlefield Report: Volume & Market Internals

The capitulation setup extended into Monday (3/10) with an S&P 500 10% downside Capital Weighted Volume (CWV) day—97% of the volume flowed out, and Capital Weighted Dollar Volume registered 96% outflows. However, Friday delivered a counteroffensive: a 10% upside CWV day, with 90% of volume and 93% of capital flows moving back in. S&P 500 volume remained above average throughout the week.

Surprisingly, despite the index declining over -2% on the week, upside volume outpaced downside volume, and capital outflows only slightly exceeded inflows. Internals remain on the brink, with Capital Weighted Volume, Dollar Volume, and the NYSE Advance-Decline line all hovering near long-term trendlines—CW Dollar Volume and the AD Line slightly above trend, while CW Volume sits marginally below trend.

Troop Movements: Leadership Flips

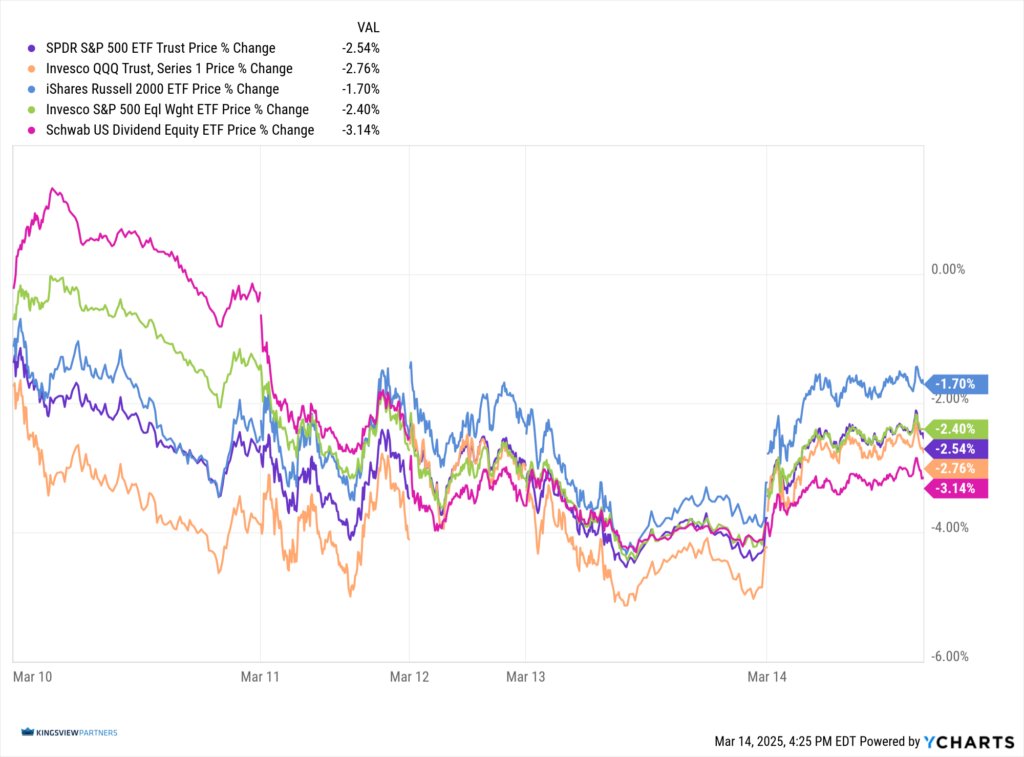

This past week saw notable shifts in market leadership, with our top forces and former strong holds both retreating under heavy fire:

- Generals (QQQ – Invesco Nasdaq-100 Trust): -2.76%

- Elite Forces (SPY – SPDR S&P 500 ETF): -2.54%

- Brass Commanders (RSP – Invesco S&P 500 Equal Weight): -2.40%

- Brass Commander (SCHD – Schwab U.S. Dividend ETF): -3.14%

- The Troops (IWM – iShares Russell 2000 ETF): -1.70%

The broad-based decline suggests weakness across both large-cap growth (QQQ) and dividend/value-focused equities (SCHD), while small-cap troops (IWM) showed relative resilience. This reinforces the narrative that the market may have temporarily exhausted selling pressure, setting the stage for a potential rebound.

Strategic Outlook: Key Resistance and Support Levels

If the bears have exhausted their ammunition, the next resistance level for the bulls is 5650, with stronger defensive fortifications at 5950. However, should the bears regroup for another offensive, support lies near this week’s lows around 5500, with major reinforcements stationed at 5200.

Despite the recent carnage, market internals—though battered—still hold the line. Volume sentiment suggests the decline may have been too sharp, too fast, hinting at the potential for a counteroffensive rally. The battle is far from over, but the tide may be turning. Stay vigilant and prepare for the next move.

Grace and peace my friends,

BUFF DORMEIER, CMT

Updated: 3/17/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.