Volume Analysis | Flash Market Update – 7.29.24

And Then There Were None Part V

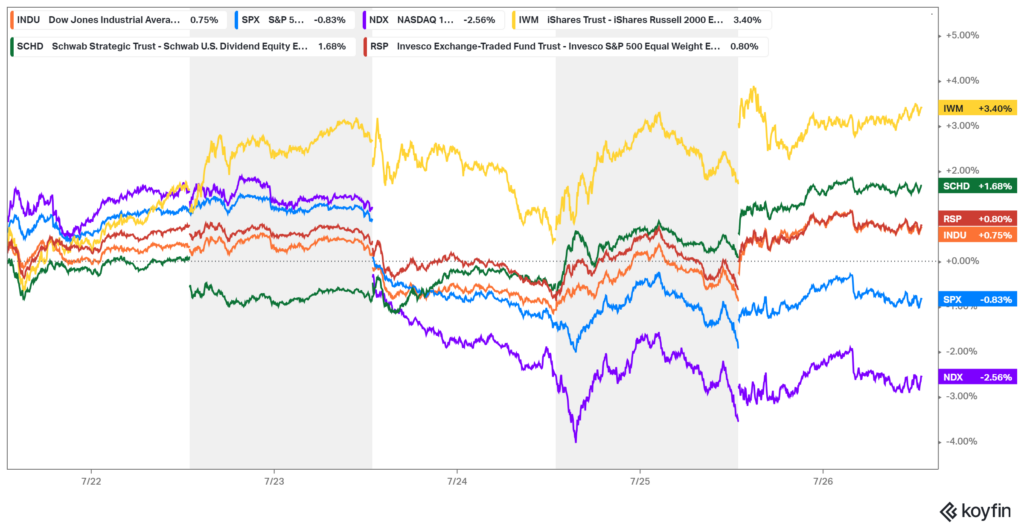

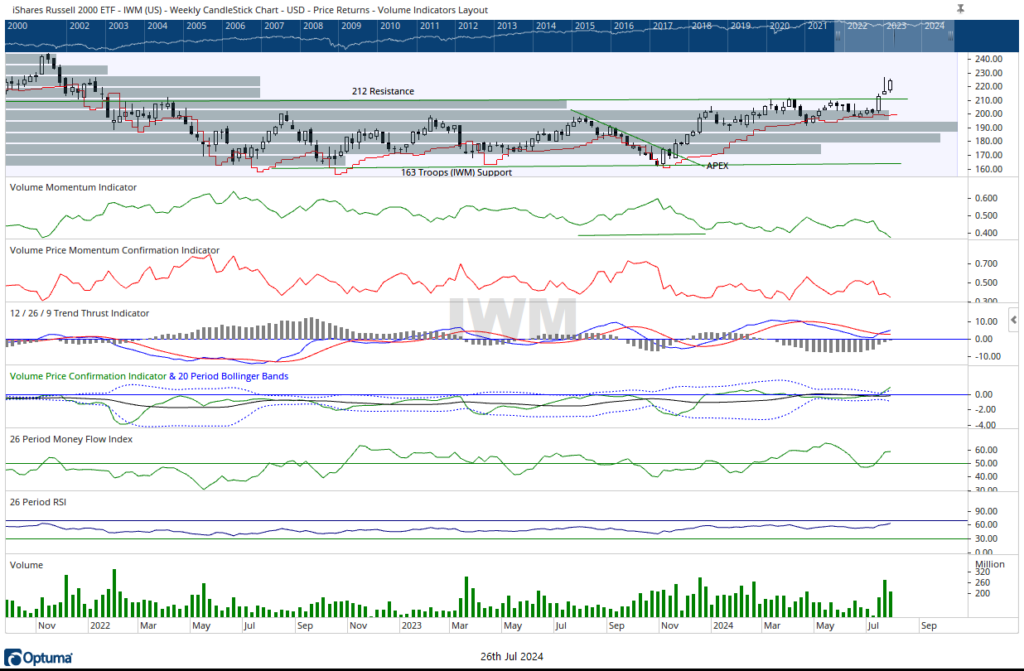

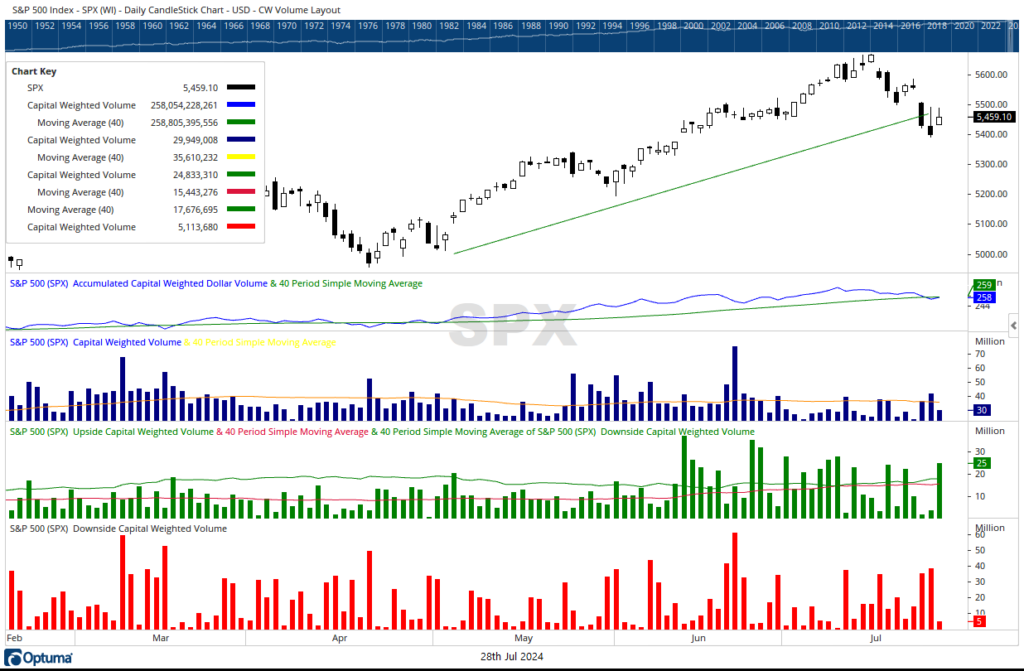

Last week, the markets continued to broaden, playing out our “And Then There were None” rotation theme from late June. The troops (IWM) once again cut into the general’s (NDX 100) leadership, finishing the week up 3.40% while the generals lost -2.56%. The S&P 500 started and ended the week well, with strong performances on Monday and Friday. Monday’s SPX 500 upsurge was accomplished on 77% Capital Inflows. However, the trading occurred on lighter than average Capital Weighted Volume. Similarly, Friday’s SPX rally also occurred on below-average volume with 82% of the Capital Flows to the upside.

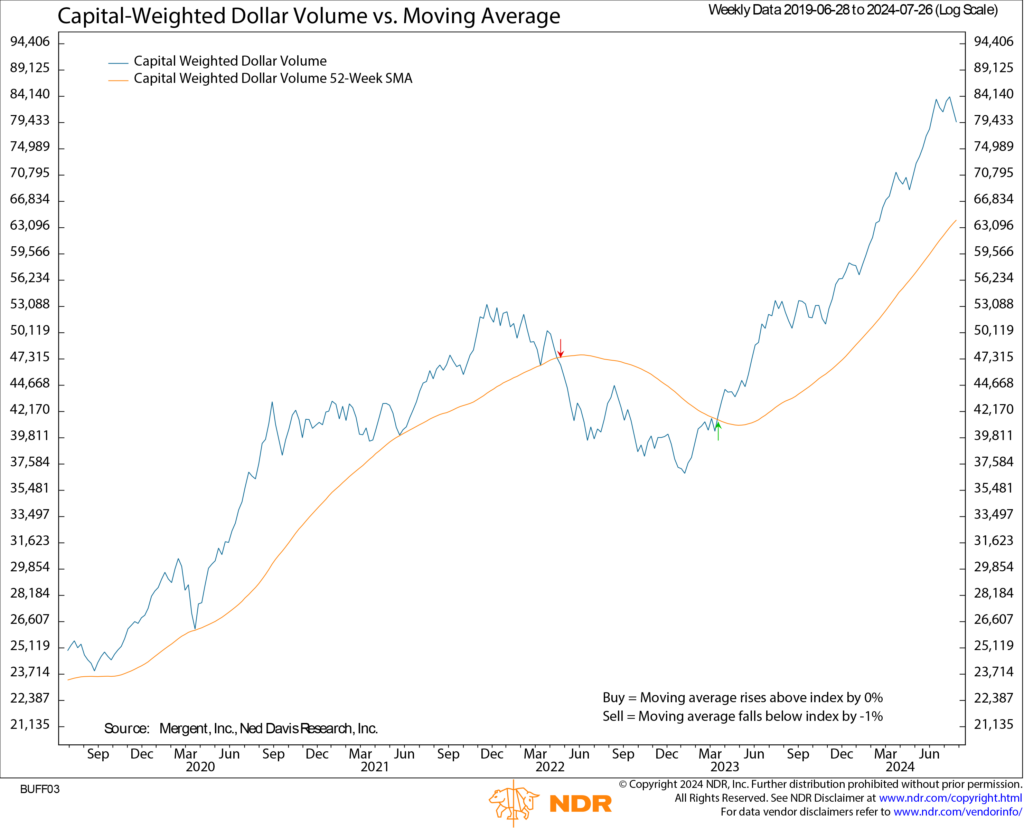

Despite the strong start and finish, the S&P 500 finished the week down -0.83%. On Wednesday, 7/24, and Thursday, 7/25, the S&P 500 suffered consecutive 90% downside days, both on high volume. 96% of the Capital Flows were to the downside on Wednesday, while 91% of the flows were downward on Thursday. Overall, $61.7 billion flowed into the S&P 500 for the week, with $98.9 billion moving out. Both the trends of S&P 500 Capital Weighted Volume and Dollar finished with major losses on the week, yet their intermediate uptrends appear to remain strongly intact.

While money has been moving out of the capital-weighted indexes, it appears to be moving towards the broader regions of the market. This rotation is evidenced by the troops’ 3.40% weekly gain and positive finishes by dividend stocks, such as the Schwab US Dividend Equity ETF (SCHD) and the Invesco S&P 500 Equal Weight ETF (RSP). Moreover, the NYSE Advance Decline closed the week slightly higher, notching another all-time high.

The S&P 500 closed just above the 5440 support level. This support level is both lateral and an apparent trend. If the S&P 500 index doesn’t rise over the next week, it may break trendline support by not keeping up with the rising trendline. Should this line break, the next area of support resides at 5300. Short-term resistance is now at 5500. Meanwhile, the troops (IWM) are trading inside last week’s range of 227 resistance and 214 support.

Grace and peace my friends,

BUFF DORMEIER, CMT

Updated: 7/29/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.