Volume Analysis | Flash Market Update – 10.14.24

And Then There Were None – A Cautious Advance

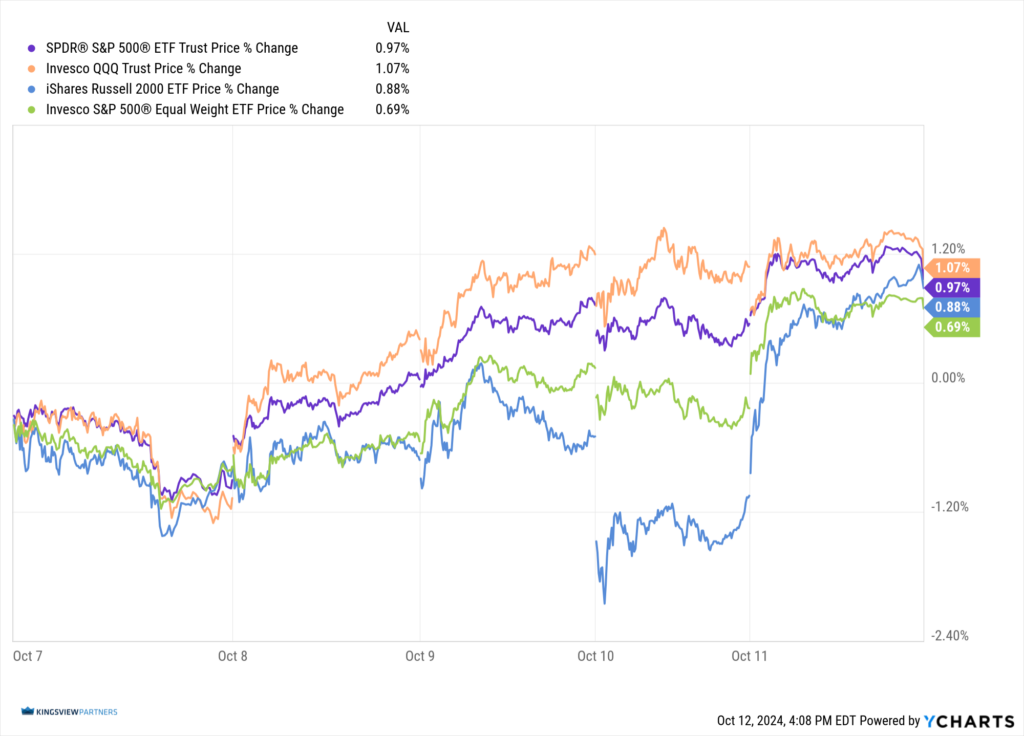

The market’s generals Invesco QQQ Trust (QQQ) led another charge last week, but the advance appears to lack the thunderous support of heavy volume artillery. For the second consecutive week, the QQQ vanguard pushed forward, gaining 1.07%, with the capital weighted SPDR S&P 500 ETF (SPY) close behind, up 0.97%. The foot soldiers, iShares Russell 2000 ETF (IWM), marched steadily, rising 0.88%, while our seasoned brass commanders, Invesco S&P 500 Equal Weight ETF (RSP) brought up the rear, advancing 0.69%. Thus, all our major price component units advanced on the week.

Though the week’s skirmishes were mostly quiet affairs, Tuesday’s battle saw a decisive victory for the bulls. They controlled a staggering 97% of the day’s upside volume, a tactical maneuver reminiscent of a classic flanking operation. However, outside of Tuesday’s bullish triumph, the week’s minor triumph occurred on a battlefield with sparse troop deployment, raising questions about the sustainability of the offensive.

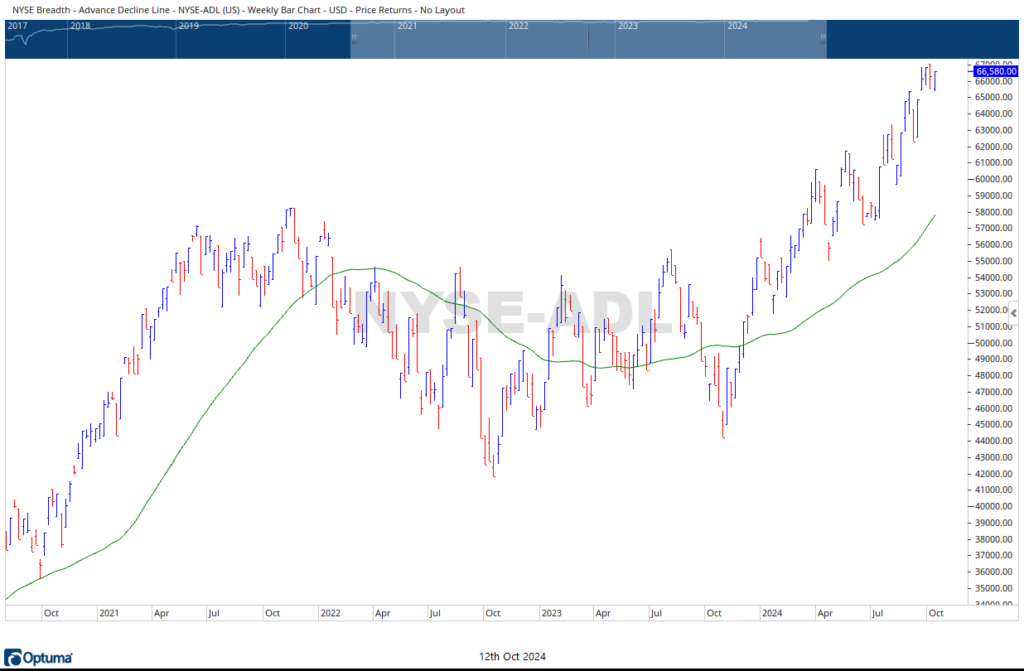

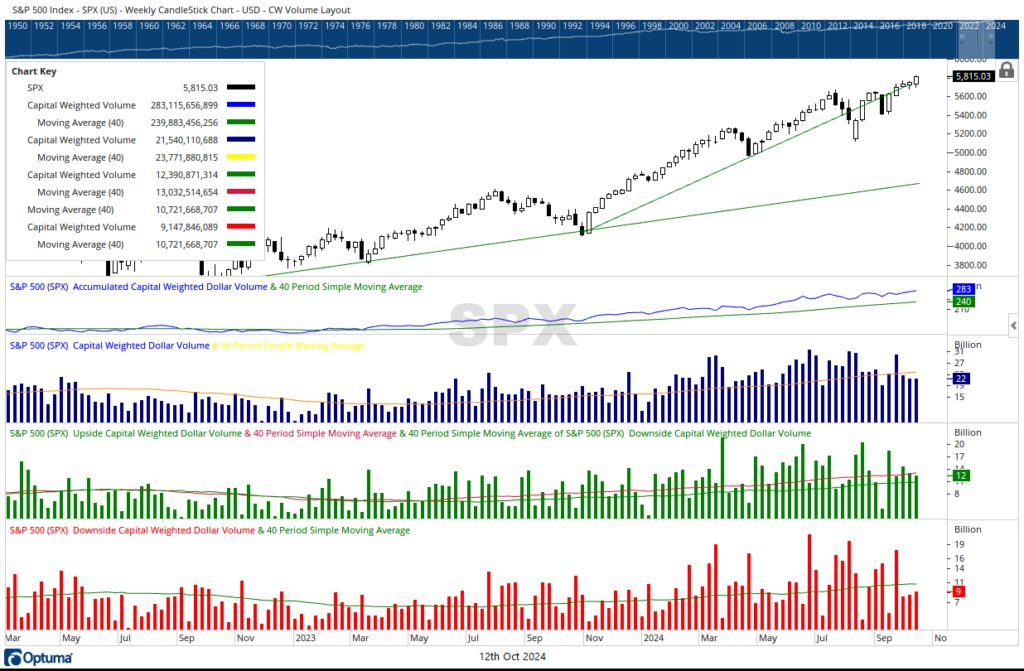

Our market breadth reconnaissance (NYSE Advance-Decline Line) reported gains in occupied territory, yet fell short of capturing the high ground alongside the S&P 500 price index. Intelligence suggests a curious movement of resources, with $12.4 Billion in reinforcements flowing into the S&P 500 camp, while $9.1 Billion retreated from the field.

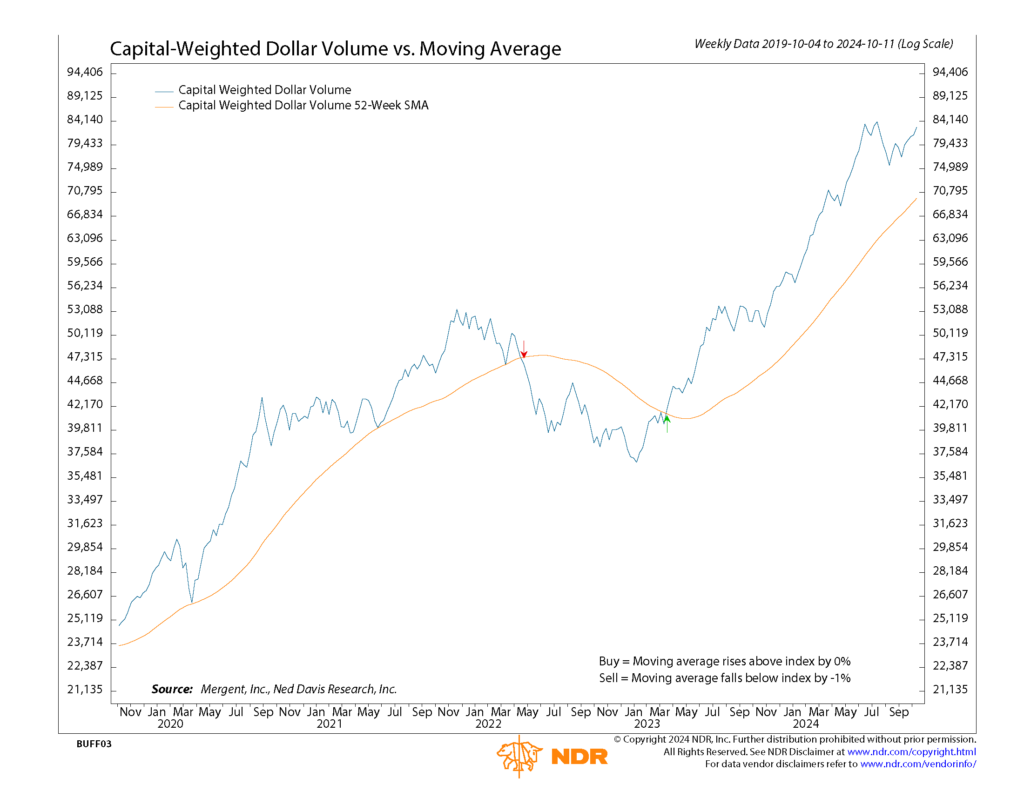

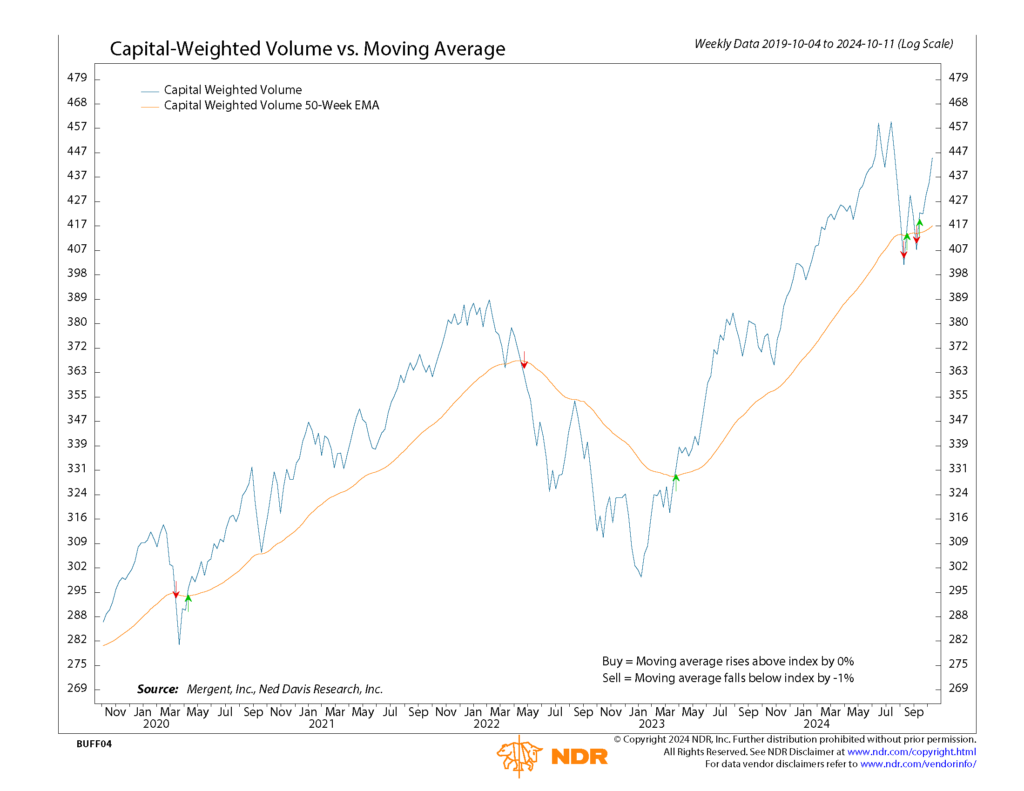

Our most trusted leading indicators, S&P 500 Capital Weighted Volume and Capital Weighted Dollar Volume, have reversed course from their recent tactical retreats. These stalwarts now advance cautiously, still lagging behind the more aggressive price index units.

The overall campaign sees price leading the charge, with both market breadth and volume indicators approaching fortified resistance lines. This daring push without strong support from our supply lines (volume) and allied forces (breadth) could leave our positions vulnerable to counterattack.

As we survey the battlefield, we’re reminded of the old military adage: “Amateurs talk strategy, professionals talk logistics.” While the price action appears victorious, the lack of volume reinforcements suggests we may be either overextended or awaiting post-election clarity. Commanders should remain vigilant, prepared for potential ambushes or sudden reversals in the coming engagements. The next few pre-election battles could decisively shape the course of this market campaign.

Grace and peace my friends,

BUFF DORMEIER, CMT

Updated: 10/7/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.