Portfolio Manager Insights | What Fed Rate Cuts Mean for Investors – 9.18.24

The Federal Reserve’s interest rate decisions remain a focal point for markets. While the timing and size of rate cuts are the subject of debate, why the central bank is cutting rates and how the full rate cut cycle might play out are far more important. This is because the implications are not as straightforward as they might seem, and market expectations have shifted dramatically over the past year. What should investors know about how rate cuts have historically impacted the economy and markets?

The rationale behind Fed rate cuts is important

The Fed typically lowers interest rates in response to a weakening economy, since doing so makes it cheaper for individuals and companies to borrow, while also increasing the incentive to spend rather than save. In theory, this boosts growth and supports the financial system, especially during recessions and financial crises. Over the past few decades, the Fed made dramatic rate cuts during the early 2000s dotcom bust, the 2008 global financial crisis, and the pandemic in 2020.

How the economy and markets typically behave during rate cut cycles can be easily misunderstood from these historical episodes. While lowering rates is intended to promote growth, doing so during an economic crash means that a recession and bear market are likely to follow and last several quarters after the first cut. This means that rate cuts are historically correlated with poor market returns even though it’s clear that rate cuts were in response to, rather than the cause of, these challenges.

Conversely, while rate hikes are typically seen as slowing the economy, they often occur during economic booms and bull markets as the Fed slowly pumps the brakes. Thus, counterintuitively, rate hikes have historically corresponded to strong returns.

Today, the Fed is not battling a sudden economic collapse or financial crisis, but is instead navigating a period of steady but slowing growth with improving inflation and a weakening but still strong labor market. In other words, the current situation is quite different from periods of emergency rate cuts. This is why the rationale for lowering rates matters when considering how they might impact markets in the months and years ahead.

Perhaps a more applicable example is the 1994-1996 rate cycle, when the Fed raised rates to combat inflation fears before lowering them again shortly thereafter. Periods like these are often referred to as “soft landings” since the Fed arguably managed to cool the economy without triggering a recession. While there was a significant shock to the bond market – just as there was in 2022 – markets eventually responded positively to rate cuts once the economy stabilized.

The Fed’s task is to balance inflation and growth

The Fed’s dual mandate, as described in the 1977 Federal Reserve Act, is “to promote maximum employment and stable prices.” Today, this is interpreted as returning inflation to 2% while ensuring the economy continues to grow steadily.

These objectives can be in conflict, since faster growth should, in theory, result in higher inflation. From 2009 to early 2020, inflation was nearly non-existent, allowing the Fed to keep interest rates exceptionally low resulting in one of the strongest job markets in history. In contrast, the inflation of the past few years has required the Fed to make tough choices between price stability and jobs.

Fortunately, inflation has been improving since its peak in 2022. The latest Consumer Price Index report showed that prices continued their gradual descent in August, with the headline index rising only 2.5% year-over-year. However, the Fed is hesitant to declare victory since core CPI, which excludes volatile food and energy prices to measure the underlying trend, experienced a slight uptick to 3.2%. This was primarily due to stickiness in housing prices which has been a point of concern for economists.

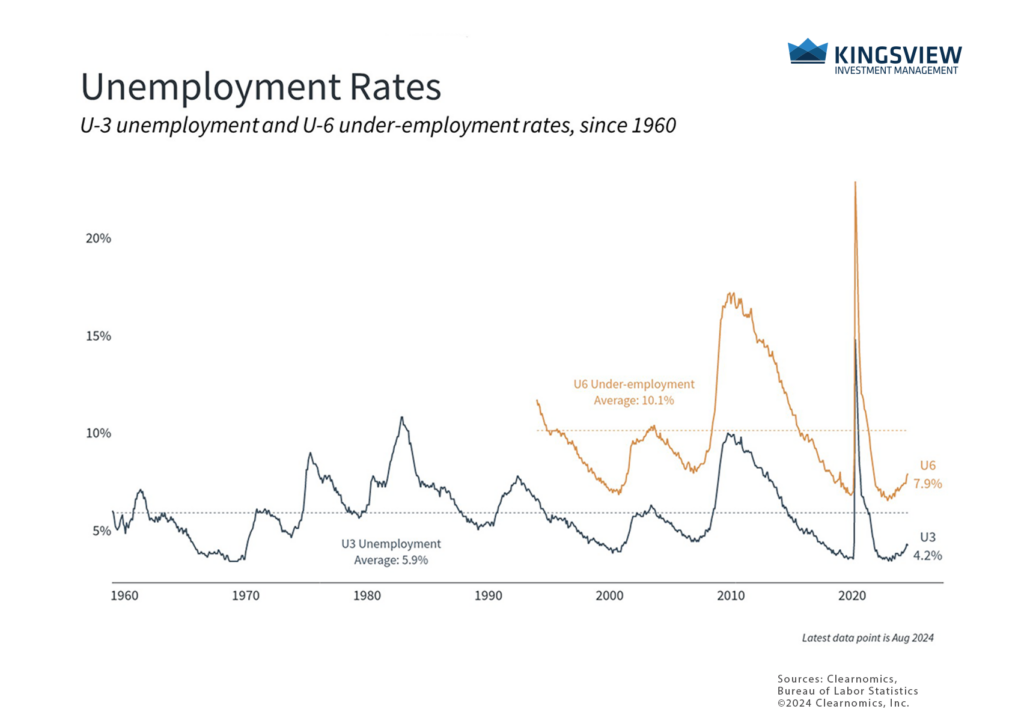

It’s been said that monetary policy works with “long and variable lags.” In other words, if the Fed waits for inflation to be all the way back down to 2%, it may have waited too long. The cost of doing so would be an over-tightening of the job market, which would have real world consequences on households and businesses. Thus, the recent softening in the employment data provides further support for reducing rates.

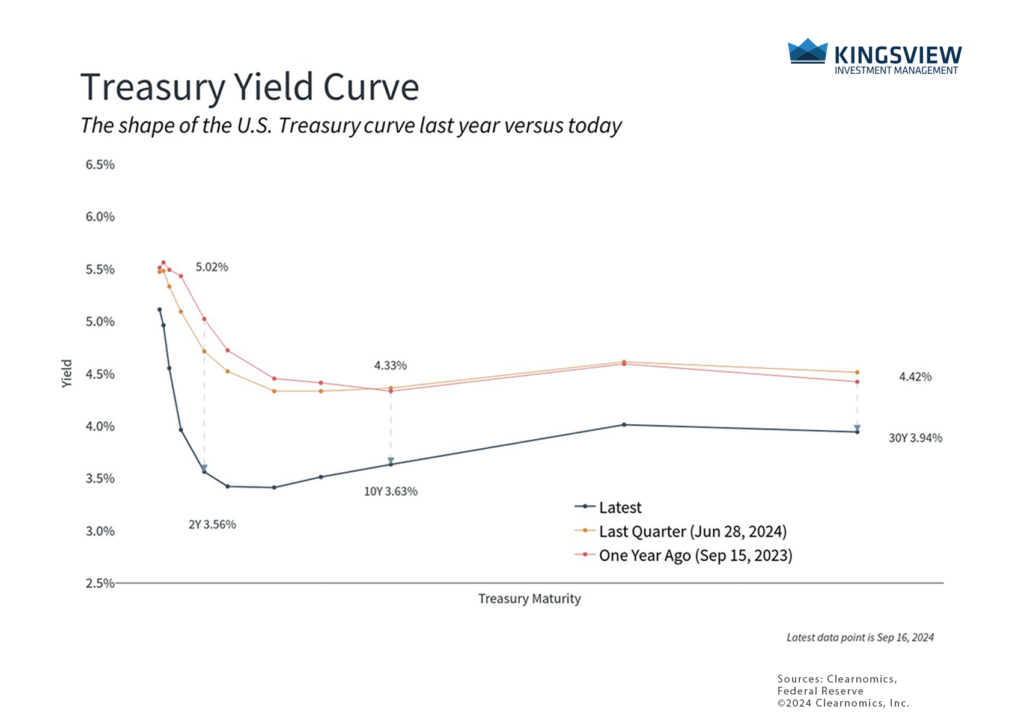

Bond yields are adjusting to rate cuts

Given these economic trends, most economists and investors believe the Fed will cut rates a few times this year and throughout 2025. Bond yields have responded with the yield curve “disinverting” for the first time since the rate hike cycle began in 2022. This is because short-term interest rates, which are tied to Fed policy, have begun to fall while long-term interest rates, which are tied to economic growth, have not declined as much. This results in an “upward-sloping” yield curve which is often seen as positive for the economy.

While the past is no guarantee of the future, lower rates have been positive for both stocks and bonds across history. Bond prices, in particular, move in the opposite direction of bond yields, which is why many bond indices have rebounded in recent weeks.

For stocks, lower interest rates mean that businesses have access to cheaper financing for investment and expansion. When it comes to the math of valuing companies, lower rates mean that future cash flows are discounted less, which can result in more attractive prices today. Of course, the market never moves up in a straight line, and investors should always be prepared for periods of volatility as the financial system adjusts to Fed moves.

As we enter a new phase of monetary policy, economists will be closely monitoring these indicators, particularly those related to employment and growth. The Fed’s challenge will be to calibrate its policy response to support the economy without reigniting inflationary pressures or creating imbalances in financial markets.

The bottom line? Understanding why the Fed is cutting rates is as important as the policy moves themselves. Rather than focus on individual rate cuts, investors should maintain a long-term perspective to stay on track toward their financial goals.