Volume Analysis | Flash Update – 11.4.24

And Then There Were None Part X

In a week reminiscent of Agatha Christie’s “And Then There Were None”, the market’s elite forces faced a strategic retreat. The generals, Invesco QQQ Trust (QQQ) led the charge downward, finishing the week with a -1.50% casualty rate, dragging down their comrades in the SPDR S&P 500 ETF Trust (SPY) by -1.28%. As if following a sinister plot, the market’s broadening theme continued, with the brass commanders, the Invesco S&P 500 Equal Weight ETF (RSP) and Schwab US Dividend Equity ETF (SCHD) suffering lighter losses of -0.94% and -0.14%, respectively. In this tale of market attrition, only the wayward troops, iShares Russell 200 ETF (IWM), managed to survive unscathed, eking out a small gain of +0.13%.

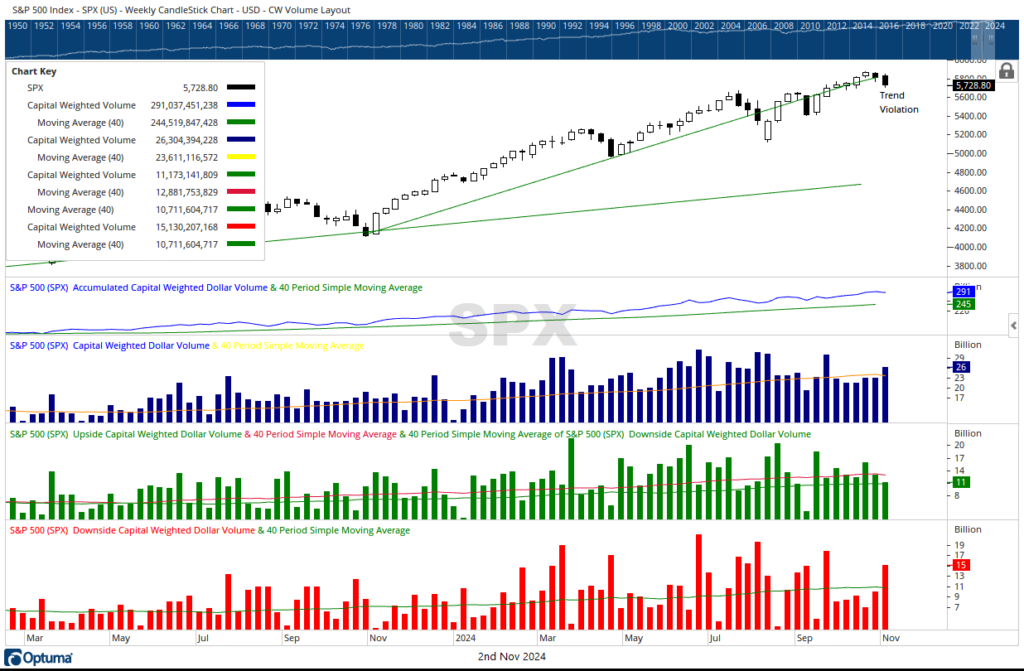

Though the S&P 500 remains entrenched above its primary defensive line (the 200-day moving average), it has breached the rising cyclical trendline established almost exactly a year ago. Like a fortress under siege, this marks the third assault in four months that has penetrated this upward fortification, suggesting its defenses are weakening.

The bears orchestrated a powerful offensive, with over $15 billion in capital fleeing the S&P 500 battlefield, compared to only $11 billion in reinforcements. Thursday saw another heavy assault with a strong 10% Downside Capital Weighted Volume day, as $6.7 billion in bearish forces overwhelmed a mere $200 million in bullish resistance. This financial bloodbath occurred on the heaviest Capital Weighted Volume since the minor September correction.

In the broader theater of war, market breadth, as measured by the NYSE Advance-Decline Line, retreated for the second consecutive week. However, like a strategic fallback, it maintains its position above the intermediate-term trend and short-term support level. The Capital Weighted Volume indicators, despite reaching new heights last week, have slightly withdrawn, still lagging behind their price counterparts in this market mystery.

As the plot thickens, the market has sustained short-term damage, backed by formidable bearish reinforcements. Yet, like the resilient characters in Christie’s novel, the intermediate and long-term trends remain steadfast, refusing to succumb to the bearish onslaught. As we turn the page on this week’s market election narrative, one must wonder: who will be the next to fall, and which Nephilim survive this treacherous market island?

Grace and peace my friends,

BUFF DORMEIER, CMT

Updated: 11/4/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.